- Home

- /

- News

- /

- January 2026

- /

- FIFA World Cup 2026: Demand for Short-Term Rentals Is Not the Risk. Execution Is.

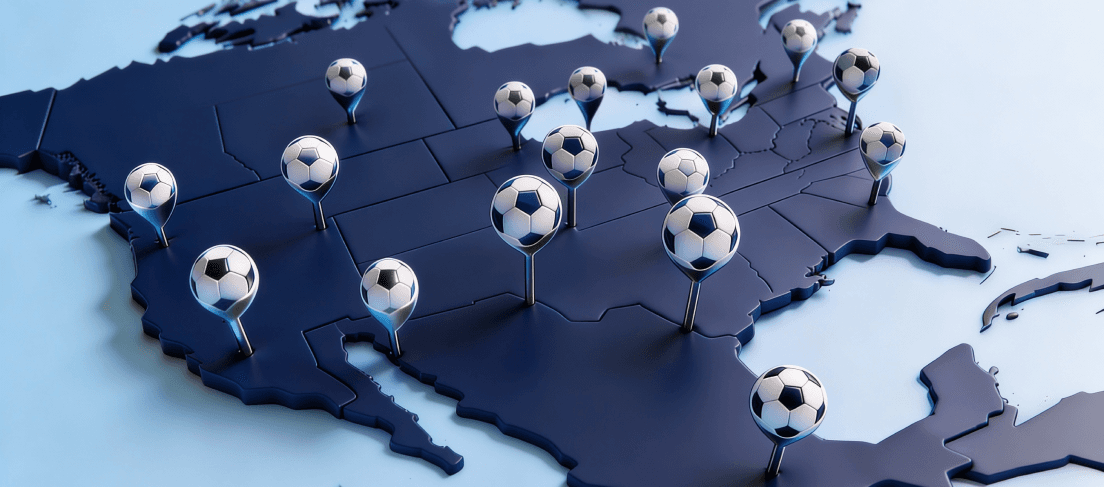

FIFA World Cup 2026: Demand for Short-Term Rentals Is Not the Risk. Execution Is.

Summary

The FIFA World Cup 2026 presents a significant revenue opportunity for short-term rental hosts, but success hinges on precise pricing and control, not just demand. Hosts should avoid treating the entire tournament window as a typical peak season and instead, focus on demand behavior and match gravity to maximize revenue.

Key Insights

- •Early-signal markets are defined by timing, not volume; booking windows stretch earlier than normal, and demand clusters around specific dates rather than spreading evenly. Volume-led markets see occupancy start moving, with calendars filling, and dashboards looking healthy.

- •Demand concentrates around match days, not the entire tournament window, with booking behavior shifting, especially around the dates that matter most.

- •The revenue gap between confident operators and reactive operators widens fast.

Action Items

- ✓Price by demand behavior and match gravity, not by month. Use restriction zoning, tight where justified, flexible where necessary. Define pacing triggers and actions now, before emotion enters the room.Effort: mediumImpact: high

Common Mistakes

- ⚠Managing by averages during the World Cup, as peaks matter far more than averages and connector nights determine whether value is captured or lost.

- ⚠Treating the entire tournament window as one block; underpricing true peaks or overpricing nights that still need to convert normally.

More from Pricing & Profitability

Airbnb is offering a $750 incentive for some hosts in Georgia during the FIFA World Cup, potentially boosting occupancy and profitability. This program seeks to capitalize on increased demand from the international event, offering financial benefits to participating hosts. Learn how to qualify and leverage this incentive for your STR.

Las Vegas tourism saw a sharp decline in 2025, experiencing its worst year since the pandemic with a 7.5% drop in visitor arrivals. Hotel occupancy decreased by 3.3 percentage points, and average daily rates fell by 5%. Learn how economic shifts can affect your STR business, and explore strategies to mitigate risk.

Choice Hotels is strategically shedding underperforming properties in the U.S. while expanding internationally. This has resulted in a 2.9% net decrease in U.S. rooms, while globally they saw a 1% increase. This shift reflects a focus on higher-quality properties and potentially higher fees, impacting the competitive landscape for hosts.

Curated by Learn STR by GoStudioM