The STR tax loophole

Summary

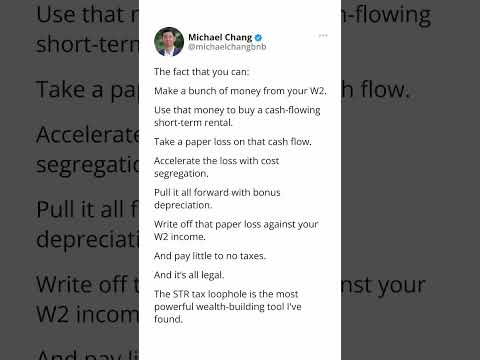

This video explains the 'STR Tax Loophole,' a strategy allowing W2 earners to use short-term rental losses to offset their active income. By using cost segregation studies and meeting material participation requirements, investors can front-load depreciation to significantly reduce their tax burden.

Related Videos

Related News

The 2026 State of Real Estate Investing: An “Easier” Road Ahead

This BiggerPockets article discusses the state of real estate investing in 2026, suggesting that deal flow and cash flow are improving, making it a potentially easier time for investors. Hosts should be aware of these market trends and consider adapting their strategies to take advantage of the changing landscape.

How to Choose the Right Revenue Manager for STRs

This article discusses the importance of revenue management in short-term rentals, especially in a more competitive market. It covers different revenue management ownership models (DIY, in-house, outsourced), highlights the need for education and analytical skills, and emphasizes the impact of revenue management on profitability. Hosts should evaluate their current revenue management strategies and consider whether they need to optimize their approach to maximize revenue.

Investors shy away from short-term rentals - Times News Group

This article indicates a shift in investor sentiment, with investors becoming less interested in short-term rentals. Hosts should stay informed about market trends and assess the potential impact on their properties and investment strategies.