This is how wealthy people stay wealthy

Summary

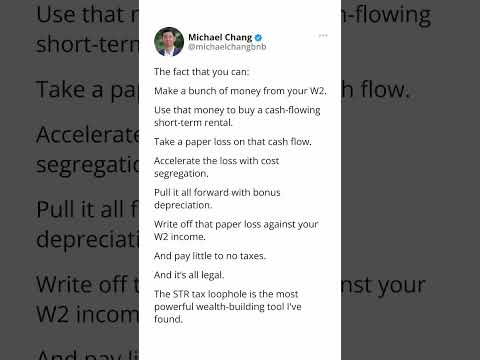

This video explains the 'STR Tax Loophole' which allows W-2 earners to use short-term rentals to significantly reduce their tax liability. It highlights several major deductions including cost segregation, bonus depreciation, mortgage interest, and home office expenses, demonstrating how one property can generate over $440,000 in first-year deductions.

Related Videos

Related News

Investors shy away from short-term rentals - Times News Group

This article indicates a shift in investor sentiment, with investors becoming less interested in short-term rentals. Hosts should stay informed about market trends and assess the potential impact on their properties and investment strategies.

2026 Home Price Predictions: Will the Correction Continue?

This article discusses the 2026 home price forecast, predicting flat or modestly declining home prices. Hosts should be aware that appreciation may be slow or negative and adjust their financial planning accordingly.

Oyo-Parent Prism Files for IPO, Seeks $7+ Billion Valuation

Oyo's parent company, Prism, is planning an IPO in India, which could become the largest in the Indian travel sector. While this news is primarily about a company's financial plans, it indicates potential growth in the travel industry.